Getting Started

Merchant Processing Agreement

These Terms and Conditions apply to your card processing agreement. For simplicity, we Luqra (“LQ”) refer to ourselves as “we,” “our,” “Processor” or “us” in this document. We refer to you (i.e., the legal entity or sole proprietorship on the Application) as “you” or “your” or “Merchant.” Other parties may also be parties to this Agreement (e.g., Member Bank, Guarantor, etc.). Terms that are capitalized, but not defined, are defined in Section 18 or in the Application.Helpful Information

Website Compliance

Why is a Website Review Required?

Luqra requires a completed website for the following reasons:

- Establishes Credibility and Trust: A completed website with all essential pages (Home, Contact Us, Checkout Cart, Privacy Policy, Terms & Conditions, Refund Policy, and Shipping Policy) presents a professional image. This completeness assures customers and partners that they’re dealing with a legitimate and serious business. Trust is a critical factor in online transactions, and a fully developed website fosters this trust by providing clear information and transparent policies.

- Supports Compliance and Transparency: Having a Privacy Policy, Terms & Conditions, Refund Policy, and Shipping Policy is not just beneficial for the user; it’s often required by law, depending on your location and the markets you serve. These documents protect both the business and its customers by ensuring compliance with data protection laws, consumer rights, and e-commerce regulations.

- Facilitates Smooth Operations: For a payment processor, assessing a merchant’s website completeness is part of evaluating their business’s legitimacy and operational efficiency. A completed website with a straightforward checkout process and clear policies can reduce the risk of chargebacks, disputes, and fraud. This assessment is crucial for the payment processor to manage risk and for the merchant to secure favorable payment processing terms.

In summary, a completed website is a foundational element of a successful online business. It not only plays a pivotal role in establishing trust and credibility but also in ensuring compliance, enhancing user experience, and optimizing for search engines. For payment processors, these factors are critical in evaluating the risk profile and operational integrity of a business, influencing their decision to provide payment processing services.

Home Page Requirements

An acceptable Home page should include the following:

- Clear Branding and Value Proposition: It should instantly communicate who you are, what you do, and what value you offer to visitors.

- Navigation Menu: An intuitive menu that makes it easy for visitors to find what they’re looking for, improving their experience.

- Featured Products or Services: Highlight key offerings to immediately grab attention and showcase what you provide.

- Contact Information: Easily accessible contact details or a link to a contact page to build trust and offer support.

Great example: Dropbox Home page

Contact Page Requirements

An acceptable Contact page should include the following:

- Contact Information: Provide multiple ways for visitors to contact you, including your business’s phone number, email address, and physical address (if applicable). This information should be easy to find and use.

- Contact Form: Include a simple form that visitors can fill out to get in touch directly through the website. This form typically asks for the visitor’s name, email, subject, and message.

- Business Hours: Including your operating hours helps set expectations for when visitors might hear back from you or when they can visit your physical location.

Great example: Luqra contact page

Checkout Page Requirements

An acceptable Checkout page should include the following:

- Contact and billing information

- Shipping information (if applicable)

- Accepted card brand logos

- Links to your page policies

Great example: Monos checkout page

Privacy Policy Requirements

A good Privacy Policy page is essential for any website, especially for those involved in collecting and processing personal data. It not only complies with legal requirements but also builds trust with your users by transparently disclosing how their information is handled. Here’s what it should include:

- Introduction: Briefly describe the purpose of the privacy policy, including the types of personal information you collect and why.

- Information Collection: Detail the specific types of personal information you collect from users, how you collect it (directly from the user, cookies, etc.), and the purposes for collection.

- Use of Information: Explain how you use the collected information. This could include providing services, customer support, marketing purposes, or improvement of services.

- Information Sharing and Disclosure: Specify the circumstances under which you might share or disclose personal information to third parties, including legal requirements, service provision, or business transfers.

- Cookies and Tracking Technologies: Describe any cookies, web beacons, or similar tracking technologies you use, what information they collect, and how users can control or opt out of them.

- Data Security: Outline the measures you take to protect the security of personal information against unauthorized access, alteration, or destruction.

- User Rights: Inform users of their rights regarding their personal information, such as the right to access, correct, delete their data, or withdraw consent.

- Data Retention: Explain your data retention policy, including how long you keep the information and how it is disposed of when no longer needed.

- International Transfers: If applicable, describe how you handle data transfers across borders, ensuring compliance with international data protection laws.

- Children’s Privacy: Address how you deal with children’s privacy if your website is accessible to children under the age of 13 or another relevant age threshold according to local laws.

- Updates to the Privacy Policy: Notify users how they will be informed of any changes to the privacy policy, and the effective date of the current policy.

- Contact Information: Provide a way for users to contact you with any questions or concerns about the privacy policy or their personal information.

Helpful Links:

Shopify Privacy Policy Generator

Termly Privacy Policy Generator

Terms & Conditions Requirements

A good Terms and Conditions page serves as a legal agreement between the website owner (or business) and its users or customers. It outlines the rules and guidelines that users must agree to in order to use the website or service. Here are key elements it should contain:

- Introduction: A brief overview of the website or service and the purpose of the Terms and Conditions.

- User Agreement: A statement indicating that by using the website or service, users agree to the Terms and Conditions laid out.

- Use of the Website: Guidelines on how the website or service may and may not be used, including prohibitions on illegal use, hacking, or posting harmful content.

- Account Registration and Use: If applicable, rules regarding account creation, user responsibilities, account security, and consequences of account misuse.

- Intellectual Property Rights: Information on copyright, trademarks, and ownership of content on the website, including how users can use such content.

- User-Generated Content: Guidelines and policies for content created and posted by users, including rights over such content and how it can be used by the website owner.

- Termination of Use: Conditions under which a user’s access to the website or service may be terminated for violating terms.

- Warranties and Disclaimers: Statements disclaiming warranties regarding the website or service and limitations of liability for issues arising from its use.

- Indemnification: A clause requiring users to indemnify the website or business from claims arising from their misuse of the website or violation of the Terms and Conditions.

- Governing Law: The legal jurisdiction and governing law under which the Terms and Conditions are established.

- Amendments: Information on how and when the Terms and Conditions may be updated and how users will be informed of these changes.

- Contact Information: Details on how users can contact the website or business for any inquiries or issues regarding the Terms and Conditions.

Helpful Links:

Shopify Terms & Conditions Generator

Termly Terms & Conditions Generator

Refund/Return Policy Requirements

A good refund/return policy page is crucial for any ecommerce store or service provider, as it sets clear expectations for customers regarding returns and refunds. Here’s what it should include to be effective and customer-friendly:

- Clear Time Frames: Specify the time frame within which a product can be returned for a refund or exchange, such as 30 days from the purchase date.

- Condition of the Product: Clearly describe the condition in which a product must be returned (e.g., unused, in original packaging) to be eligible for a refund.

- Refund Process: Outline the steps a customer needs to follow to request a refund, including how to contact customer service, what information they need to provide, and any forms they need to fill out.

- Exceptions: Clearly list any products that are exempt from the refund policy, such as personalized items, perishable goods, or sale items.

- Processing Time: Inform customers of the estimated time frame for processing returns and issuing refunds.

- Contact Information: Provide contact details for customer service in case customers have questions or need assistance with their return.

Having a clear, fair, and easily accessible refund policy not only enhances customer trust and satisfaction but can also reduce the number of disputes and chargebacks. It’s a good practice to review and update your refund policy regularly to ensure it meets customer expectations and complies with any changes in legal requirements.

Helpful Links:

Shopify Refund & Return Policy Guide

Shopify Refund & Return Policy Generator/a>

Termly Shipping Policy Generator

Shipping Policy Requirements (If applicable)

A comprehensive and transparent shipping policy is key to managing customer expectations and enhancing their shopping experience. Here’s what a good shipping policy should include:

- Shipping Options and Delivery Times: Clearly list the different shipping methods available, along with estimated delivery times for each. This helps customers choose the option that best suits their needs.

- Order Processing Times: Inform customers about the time it takes to process an order before it is shipped. This is especially important during busy periods like holidays.

- Tracking Information: Explain if and how customers can track their orders. Provide information on how tracking numbers are provided and where customers can track their shipment.

- Contact Information: Provide a way for customers to get in touch if they have questions about their order or shipping policies. This could be a customer service email, phone number, or a contact form link.

Helpful Links:

Shopify Shipping Policy Guide

Termly Shipping Policy Generator

Bank Account Verification

Why we need to verify your bank account

A payment processor needs to verify a merchant’s bank account for several critical reasons, all aimed at ensuring the security and integrity of financial transactions. Here’s why this verification is essential:

- Fraud Prevention: Verifying a merchant’s bank account is a crucial step in detecting and preventing fraud. It ensures that the account is legitimately owned by the merchant applying for the payment processing service. This check helps to mitigate the risk of fraudulent activities, such as money laundering or unauthorized transactions.

- Accurate Fund Transfer: Payment processors need to ensure that the funds from sales are accurately transferred to the correct bank account. Verification of the bank account details helps in preventing errors in fund transfers, reducing financial loss for both the merchant and the processor.

- Compliance with Regulations: Financial institutions and payment processors are required to adhere to various regulatory requirements, including Know Your Customer (KYC) and Anti-Money Laundering (AML) laws. Verifying a merchant’s bank account is part of fulfilling these compliance obligations, ensuring that the business is legitimate and operates within the bounds of the law.

- Risk Management: By verifying a merchant’s bank account, payment processors assess the risk associated with providing payment services to that merchant. It’s a way to ensure that the merchant’s business practices align with the processor’s risk tolerance, especially concerning financial stability and reputability.

- Operational Integrity: The verification process is also about ensuring the operational integrity of the payment processing system. It helps in establishing a trust relationship between the merchant, the payment processor, and the banking institutions involved in the transaction process.

- Establishing Financial Responsibility: Verifying a bank account helps payment processors to gauge the financial health and responsibility of a merchant. An active and well-maintained bank account may indicate a stable business, which is less likely to encounter issues like chargebacks or payment disputes.

In summary, verifying a merchant’s bank account is a fundamental step in the payment processing setup that supports the secure, accurate, and lawful operation of online transactions. It protects all parties involved—consumers, merchants, and financial institutions—by ensuring that the financial transactions are legitimate, compliant, and conducted with minimal risk.

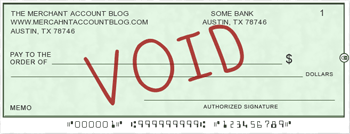

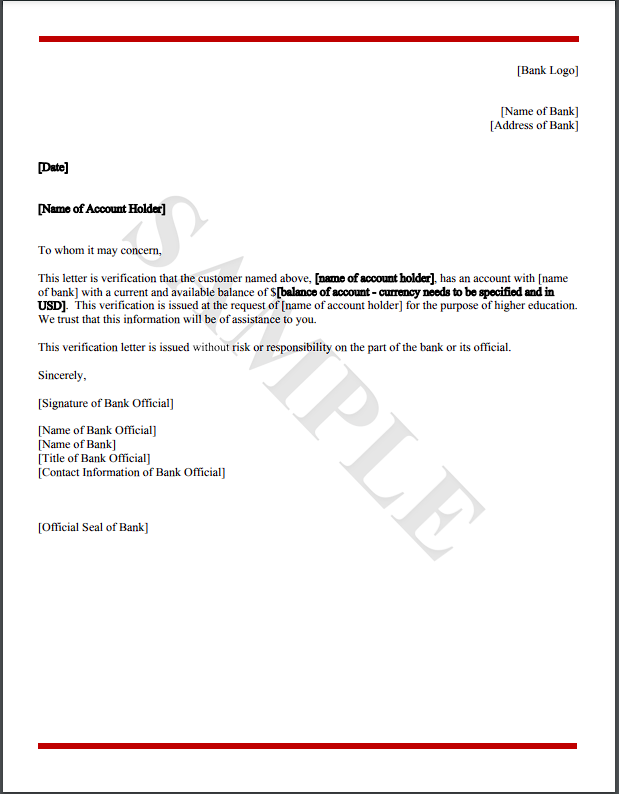

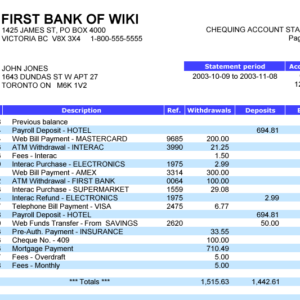

Acceptable Methods of Bank Verification

- Voided Check

- Bank Letter

- Bank Statement

|

|

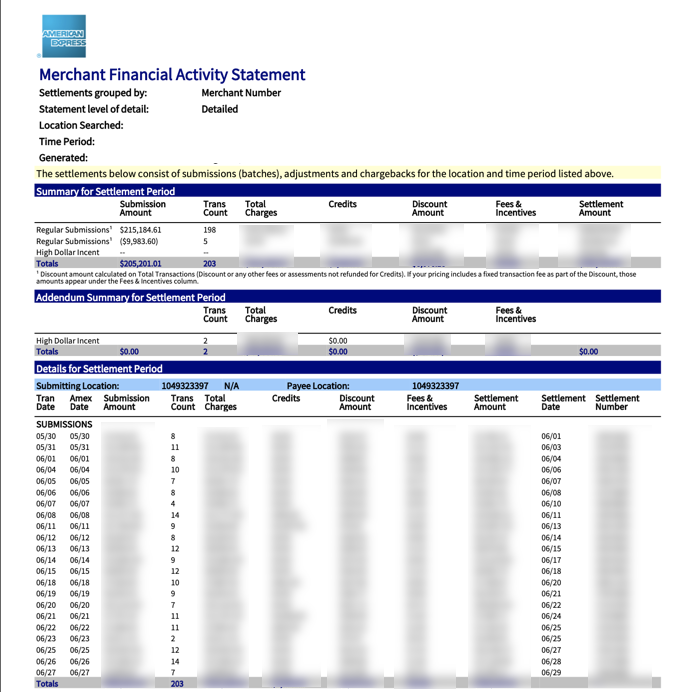

Transaction History

Why do we need bank statements?

Payment processors ask for bank statements from merchants for several important reasons, primarily related to assessing financial stability, verifying transactions, and managing risk. Here’s a closer look at why these documents are crucial:

- Verifying Financial Stability: Bank statements provide a snapshot of the merchant’s financial health over a given period. By examining these statements, processors can assess whether a business maintains a healthy cash flow, which is indicative of its ability to sustain operations and fulfill orders. A stable financial history suggests a lower risk of fraud or bankruptcy.

- Understanding Business Operations: Bank statements give payment processors insight into the day-to-day financial operations of a business. This includes regular income, expense patterns, and the average monthly sales volume. Understanding how a business manages its finances helps processors tailor their services accordingly and set appropriate transaction limits.

- Detecting Fraudulent Activity: Analyzing bank statements allows processors to spot irregularities or patterns that may indicate fraudulent activity. Unusual transactions, sudden changes in transaction volumes, or payments to suspicious entities can trigger further investigation to prevent fraud.

- Compliance and Due Diligence: Payment processors are required to comply with various regulatory requirements, including Anti-Money Laundering (AML) laws and Know Your Customer (KYC) guidelines. Reviewing bank statements is part of the due diligence process to ensure that a merchant’s business activities are legitimate and comply with legal standards.

- Risk Assessment: Bank statements help processors assess the level of risk associated with providing payment services to a merchant. A history of overdrafts, returned payments, or other negative indicators can signal a higher risk level, affecting the terms of service or fees charged by the processor.

- Verifying Business Information: Payment processors use bank statements to verify the accuracy of the business information provided by the merchant. This includes the business name, address, and banking details, ensuring that payments are processed to the correct accounts and helping to prevent misappropriation of funds.

By requiring bank statements, payment processors can effectively manage their risk, ensure regulatory compliance, and provide secure, reliable services to both merchants and their customers. This documentation is essential for establishing a trustworthy relationship between the merchant and the processor, ensuring that transactions are conducted smoothly and securely.

Business Applicant Requirements

|

Sole Owner/Proprietor Applicant Requirements

Processing History

Why we ask for processing statements

Payment processors ask for previous payment processing statements for several key reasons, all aimed at assessing the merchant’s business operations and financial health:

- Establish Processing History: These statements provide a clear record of the merchant’s sales volumes, refund rates, chargeback rates, and any fees incurred. This history is crucial for evaluating the consistency and reliability of the merchant’s business activities.

- Risk Assessment: By analyzing past processing statements, processors can identify patterns that may indicate a higher risk of fraud or financial instability. High rates of chargebacks or refunds, for example, are red flags that could affect the terms of service or fees offered to the merchant.

- Determine Pricing and Terms: The details in processing statements help processors determine appropriate pricing for their services. Merchants with higher volumes of transactions or lower risk profiles might qualify for better rates.

- Verify Business Performance: Processing statements offer an insight into the business’s performance over time, including seasonal fluctuations in sales. This helps the processor understand the merchant’s business model and forecast future transaction volumes.

- Compliance and Due Diligence: Processors are required to ensure that the merchants they serve comply with legal and regulatory standards. Reviewing processing statements is part of this due diligence, helping to ensure that the merchant’s transactions are legitimate.

- Customize Services: Understanding a merchant’s processing history allows a payment processor to offer customized services that best fit the merchant’s needs, such as advanced fraud protection for high-risk businesses or tailored payment solutions for specific industries.

Requesting previous payment processing statements is a standard practice in the payment processing industry, helping to establish a trust-based relationship between the processor and the merchant, while ensuring that the processor can manage risk effectively.

Shopify Add Staff User Login Instructions

f you are coming from Shopify Payments, you will not have payment processing statements, thus in order to establish your processing history we ask for a login to your Shopify account.

We do not need to have full access to your account, but in order for us to accurately determine your processing history please follow the below instructions:

- Login to your Shopify Account

- From the Home screen, in the bottom left corner, click “Settings”

- Click “Users and Permissions”

- Click “Add Staff”

- Enter the name and email of your relationship manager

- Under “Store Permissions” select the following:

- Orders

- Finances

- Click “Send Invite”

Your Orders and Finance sections provide the closest equivalent to the information provided by an actual Processing Statement.

Stripe Add Staff User Login Instructions

- Similarly to Shopify Payments, Stripe also does not provide processing statements, thus we ask for a login or user account in order to complete our evaluation.

- Login to your Stripe Account

- From the home page, click on the settings icon located in the top right corner of your screen

- Once in the settings menu, scroll towards to the bottom to “Business Settings”

- In “Business Settings” under the “Team and Security” section, please click “Team”

- Once in the Team page, click “New Member” located towards the middle-right side of the screen

- After clicking “New Member”, you will see several different role options, please check off “Analyst” and “Dispute Analyst”

- This will allow us to see your processing history information with Stripe

- At the top of the page, please enter the email address of your relationship manager

- Once done, click “Send Invites”

Processing Statement Submissions

Signer Identification

Why do we need a photocopy of your Driver's License or Passport?

A payment processor may ask for a photocopy of a driver’s license or passport for several critical reasons related to identity verification and compliance:

- Identity Verification: A driver’s license or passport contains photo identification and other personal details that can be used to verify the identity of the merchant applying for payment processing services. This step ensures that the individual or business is legitimate and that the person applying is authorized to do so on behalf of the business.

- Fraud Prevention: By verifying the identity of merchants, payment processors can prevent fraudulent activities. This includes ensuring that the service is not being used for illegal purposes, such as money laundering or financing prohibited activities.

- Compliance with Regulatory Requirements: Payment processors are subject to various laws and regulations, including Know Your Customer (KYC) and Anti-Money Laundering (AML) regulations. Collecting and verifying identity documents like driver’s licenses or passports is a part of fulfilling these regulatory obligations, helping to ensure that the payment processor operates within legal boundaries.

- Risk Management: Understanding who they are doing business with allows payment processors to manage risk more effectively. Identity verification is a crucial step in assessing the risk profile of a merchant, which can influence the terms and conditions of the processing agreement.

- Establish Trust: By taking steps to verify the identity of merchants, payment processors can establish a trust-based relationship with them. This is important for the integrity of the financial system and for maintaining the confidence of all parties involved, including consumers.

Requesting a photocopy of a driver’s license or passport is a standard practice in the financial industry for verifying identities, preventing fraud, ensuring compliance with legal requirements, managing risks, and building trust.

Acceptable Identification Options

|  |

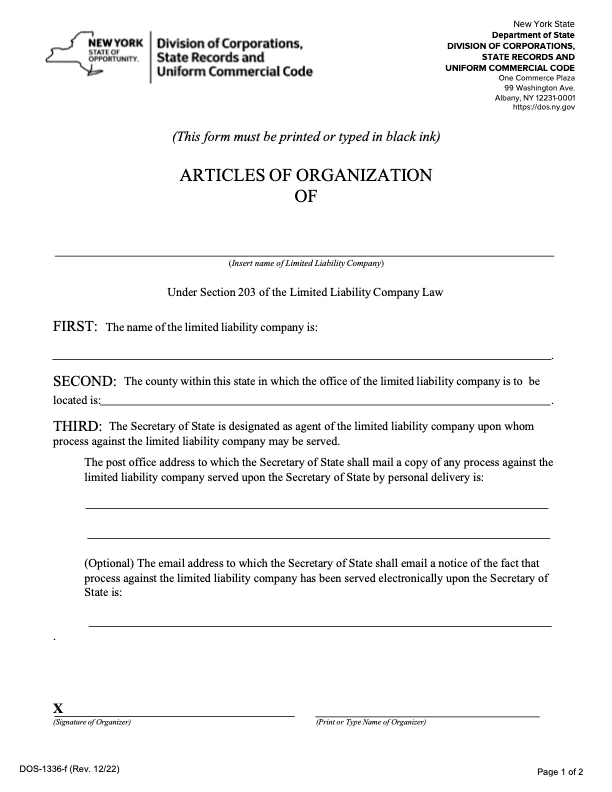

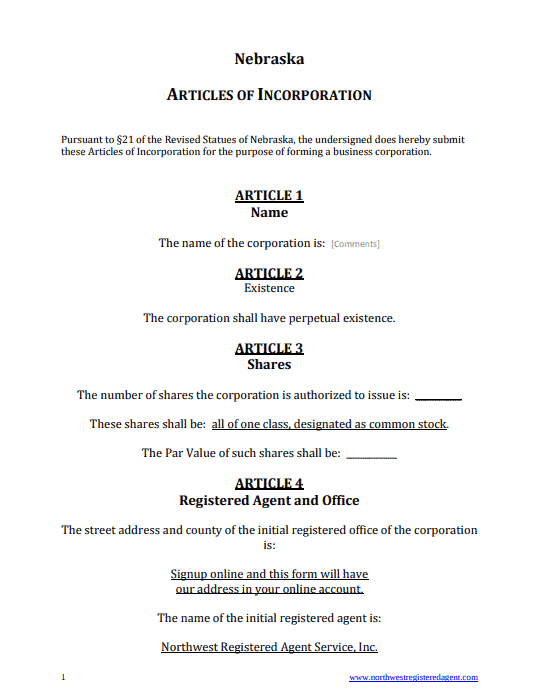

Legal Documentation

Why do we ask for Articles of Organization, Incorporation or an Operating Agreement?

A payment processor requests documents such as Articles of Organization, Articles of Incorporation, or an Operating Agreement for several important reasons:

- Legal Entity Verification: These documents officially register a business as a legal entity with the government. By requesting them, the processor verifies the legal existence of the business, ensuring it’s officially recognized and authorized to conduct business.

- Business Ownership Verification: These documents contain vital information about the business owners, members, or directors. This helps the processor confirm who owns and controls the business, which is crucial for compliance and fraud prevention efforts.

- Compliance with Regulations: Payment processors must adhere to various regulatory requirements, including Know Your Customer (KYC) and Anti-Money Laundering (AML) laws. Verifying the business’s legal documents ensures that the processor is in compliance with these laws by doing business with legitimate entities.

- Risk Assessment: Understanding the structure and ownership of the business helps the processor assess potential risks associated with providing payment processing services. For example, businesses incorporated in certain jurisdictions or industries might be considered higher risk.

- Dispute Resolution and Legal Protection: In case of disputes or legal issues, having verified the business’s legal documents can protect the processor. It ensures they have accurate information about the entity they’re dealing with, which can be crucial for resolving disputes or legal challenges.

- Operational Integrity: Ensuring that a business is properly registered and structured according to its legal documents helps maintain the operational integrity of the financial system. It prevents misuse of financial services and supports the overall health of the economic system.

By requesting these documents, payment processors perform due diligence to ensure they engage in business relationships with legitimate, compliant, and financially sound entities, reducing their own risk and contributing to a safer financial environment for all parties involved.

Proof of Articles of Organization (If applied as an LLC)

Proof of Articles of Incorporation (If applied as a Private or Public Corporations)

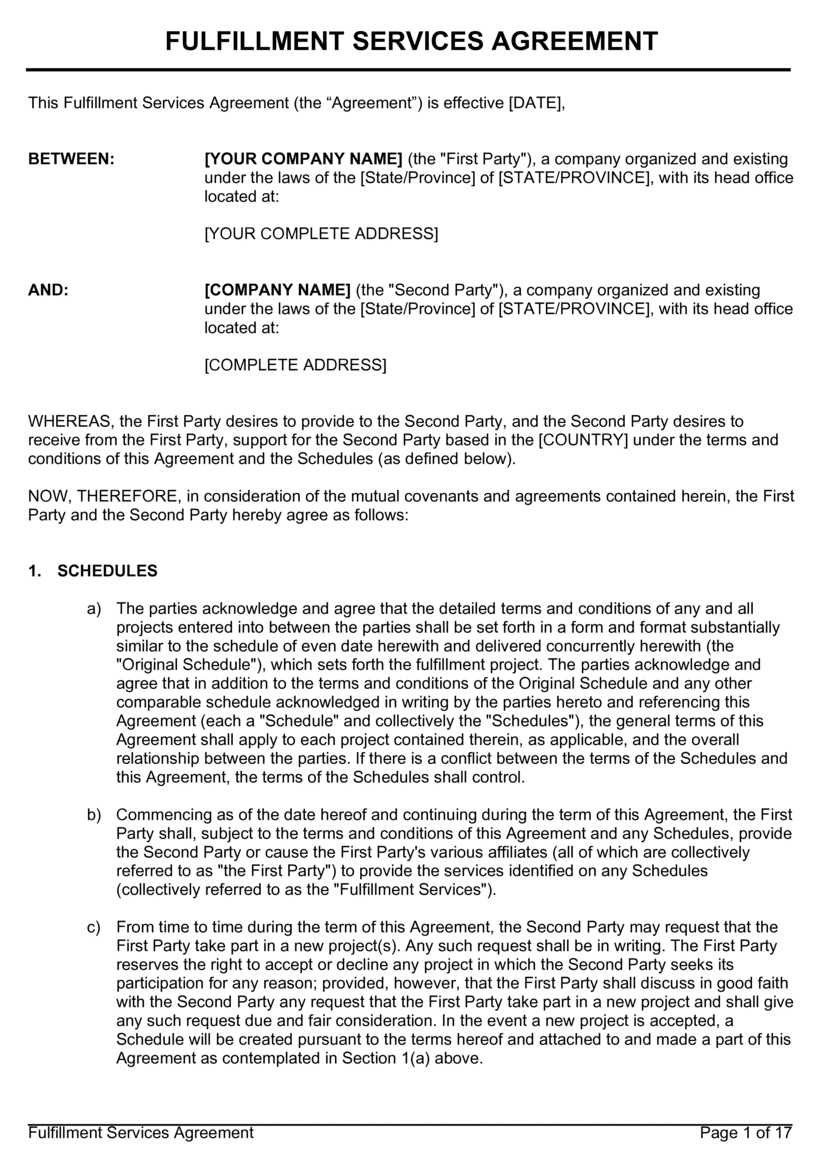

Fulfillment History

Why do we ask for proof of fulfillment?

- Verify Supplier Relationships: Proof of fulfillment confirms that the merchant has established relationships with suppliers capable of delivering products to customers. This is crucial in dropshipping, where the merchant does not hold inventory themselves.

- Assess Product Quality and Delivery Times: Payment processors are interested in ensuring that the end customers receive their products in a timely manner and that the products meet quality expectations. Delays or issues with product quality can lead to customer dissatisfaction, reflected in chargebacks and disputes that the processor will want to minimize.

- Reduce Fraud Risk: By verifying that a merchant has a legitimate process for fulfilling orders, payment processors reduce the risk of fraud. This includes avoiding schemes where orders are never fulfilled, or the business model is unsustainable.

- Compliance and Regulatory Reasons: Payment processors need to ensure that the merchants they serve comply with all applicable laws and regulations, including consumer protection laws. Having proof of fulfillment helps in demonstrating compliance with such regulations.

- Financial Stability and Business Viability: Proof of fulfillment can also serve as an indicator of the merchant’s financial stability and the viability of their business model. Reliable fulfillment processes suggest that the business is more likely to be successful and less likely to encounter financial difficulties that could affect its ability to process payments.

- Maintain Payment Network Standards: Payment networks (such as Visa, MasterCard, etc.) have standards and requirements to minimize disputes and chargebacks. Proof of fulfillment helps ensure that the merchant is adhering to these standards by delivering products as advertised.

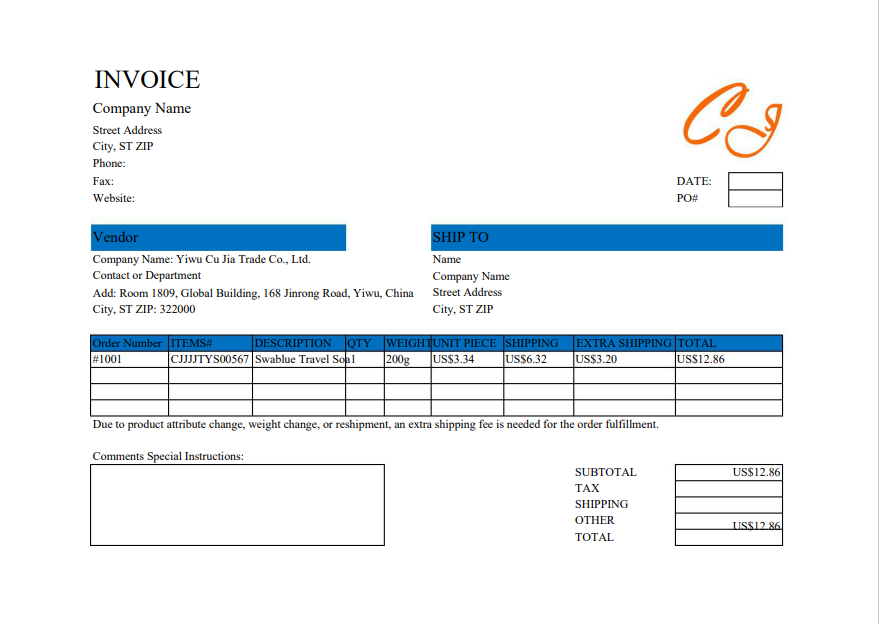

Proof of Fulfillment Options

- Option 1(Recommended): A signed contract between you and your fulfillment provider is the highest level of proof.

- Option 2: A fulfillment invoice from your provider along with proof of payment from you checking account or credit card.

- Option 3: If you are using a third party service that connects you to your fulfillment agent or agency, please provide a login to the the third party service.

Proof of Fulfillment: Service Agreement

Proof of Fulfillment: Invoices & Proof of Payment