Proactively Manage Fraud and High-Risk Business Transactions

Proactively identify, manage and prevent suspicious and potentially fraudulent transactions across any transaction, portfolio and merchant before it strikes the bottom line.

Fraud Protection That Won't Slow You Down

Avoid Delays and Losses With Proactive Management, Not Reactive Damage Control

Enables Banks and financial institutions to avoid penalties and fines for themselves and their merchants via proactive management of their portfolio

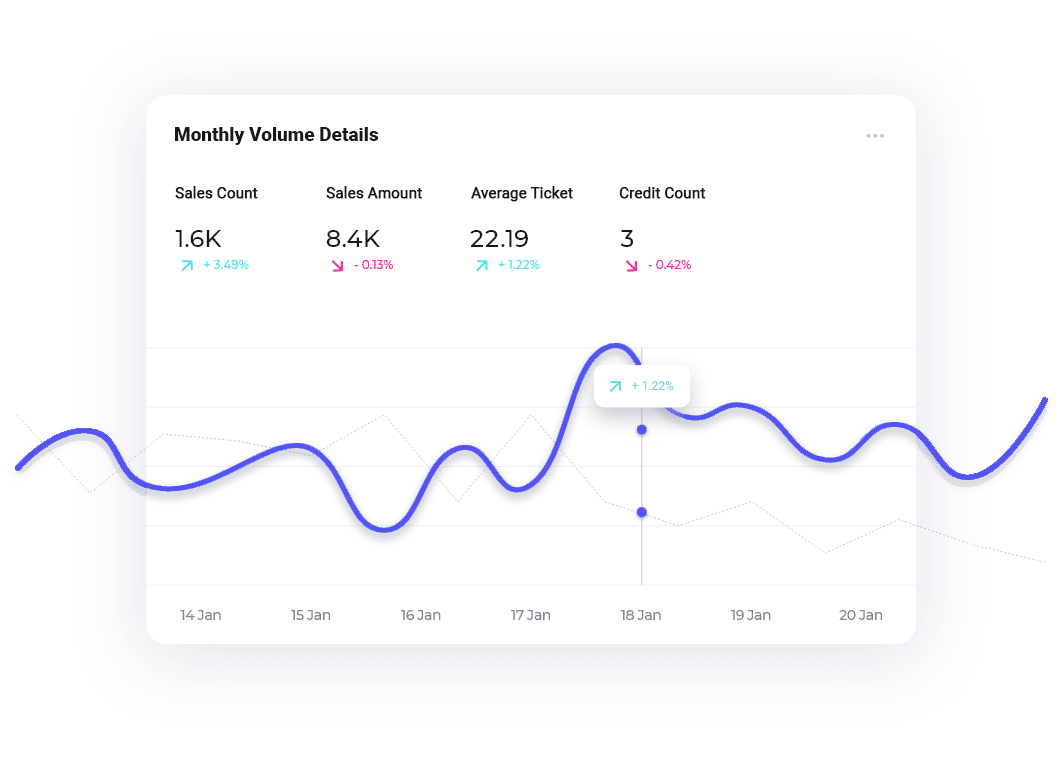

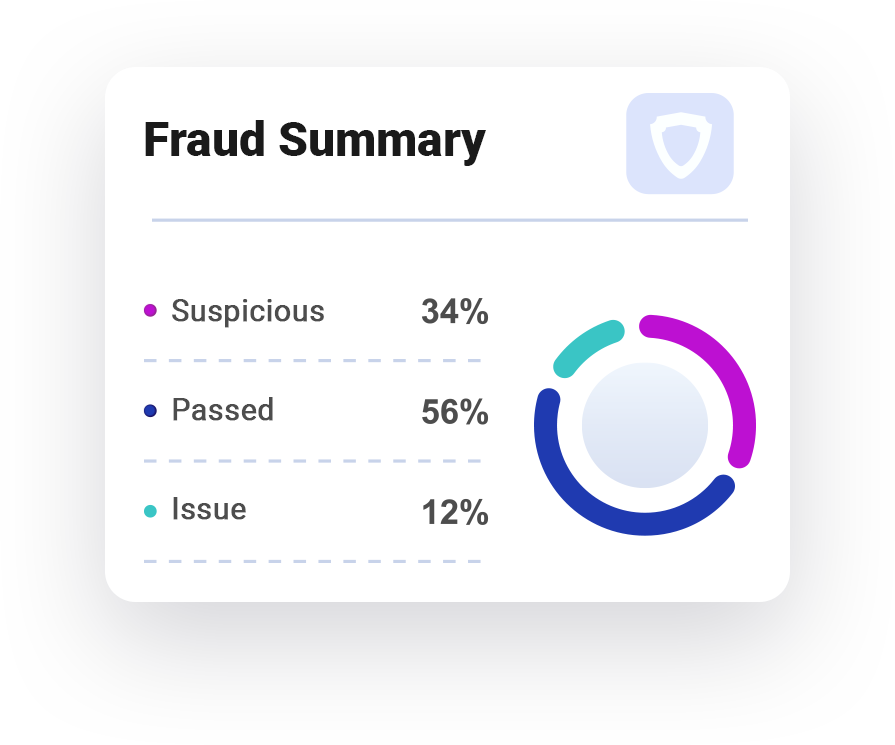

Manage fraud through intuitive account alerts and detailed drill-downs - filtered by sales channels, portfolios or individual merchants

Eliminate manual work and human errors by proactively managing and reporting fraud via a single pane of glass and smart automated workflows

Configurable fraud filters and rule-based thresholds to monitor transactions, payment velocity settings, geographic limitations, and more

Automated Prevention. Active Mitigation.

Monitoring and Analysis Capabilities

Luqra’s fraud analysis and reporting capabilities allow acquiring banks and payment processors to identify and manage high-risk business transactions before they occur.

VDMP Monitoring

Authorization declines

Same BIN

Swipe vs. keyed

Unmatched refund

First batch

Chargeback reason code

Risk exposure

See For Yourself

Schedule a Demo

Learn how Banks, FinTechs, payment processers and ISOs protect their revenue and assets by mitigating fraud before it happens using Luqra ERP.